As digital payments grow and real-time transactions become more common, fraud detection and risk management strategies must be adaptable and precise. Traditional fraud detection systems, often built on isolated, static rules, fall short in the face of complex and dynamic fraud tactics, requiring a more sophisticated approach. The Loci Risk Orchestration Language (ROL) addresses this need by providing a Domain-Specific Language (DSL) specifically for fraud detection and risk management.

As explained by Martin Fowler in this primer on Domain-Specific Languages (DSLs), DSLs offer the flexibility to create specialized languages for specific domains, simplifying complex operations and making them more adaptable. LROL leverages this DSL structure to offer a standardized, modular way to define, document, and audit fraud-risk strategies, enhancing flexibility and transparency for compliance and risk management teams.

Why Risk Orchestration Language (ROL)?

Unlike traditional fraud detection approaches, which rely on rigid “if-then” conditions, ROL is designed to be adaptable, expressive, and modular, addressing the evolving needs of modern financial services. Key objectives of ROL include:

Multi-Layered Fraud Detection: ROL enables the creation of complex fraud strategies, incorporating layered evaluations such as pattern recognition, anomaly detection, and statistical checks.

Adaptability: Designed for real-time adjustments, ROL supports dynamic risk levels, statistical analysis, and conditional logic, enabling rapid response to emerging fraud patterns.

Standardization: LROL uses a JSON-based format, creating a standardized language that improves the readability and auditability of fraud-risk strategies.

Real-Time Evaluation: Optimized for real-time processing, ROL supports immediate fraud detection and response.

Platform-Agnostic and Scalable: ROL is designed to operate across different deployment platforms and supports high scalability, allowing it to manage complex transaction loads.

ROL’s flexibility and modularity make it ideal for teams looking to define and document fraud strategies that can evolve in response to new challenges.

Overview of LROL Structure

LROL’s structure is built on JSON, with each rule comprising evaluations, conditions, thresholds, and optional statistical measures. This modular format allows rules to be defined independently, making it easy to manage and modify components as needed.

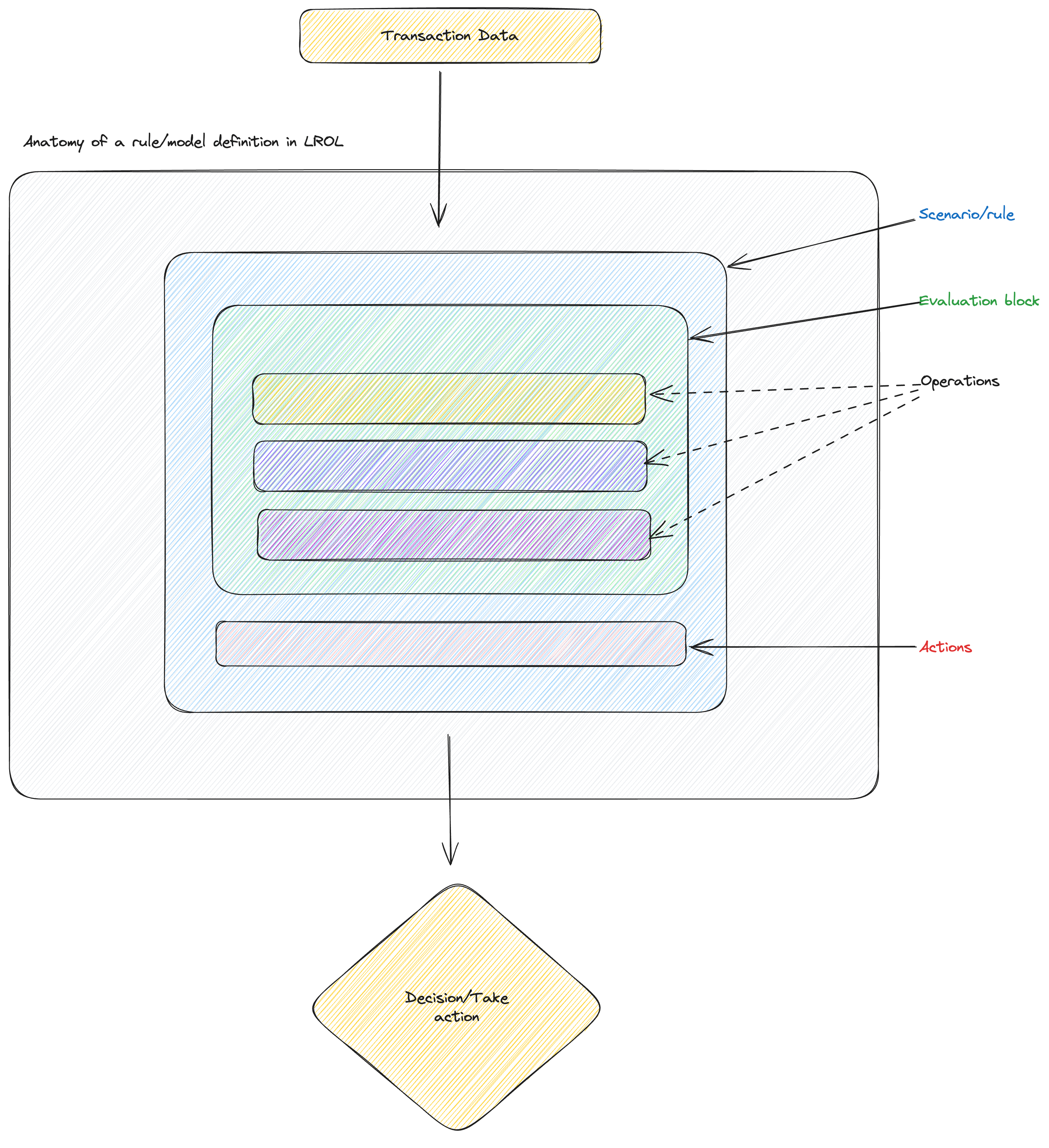

Visualizing LROL’s Structure

This diagram demonstrates how transaction data flows through evaluation layers (operations), providing a comprehensive and adaptable fraud detection mechanism in a single rule.

Developer Tooling for LROL

To help analysts and developers maximize the potential of LROL, several developer tools have been contributed (Thanks to Darmie) to the language ecosystem. These tools include:

Parser: Translates LROL’s JSON rules into a machine-readable format, allowing for easier processing and validation of rules.

Analyzer: Provides insights into rule performance, helping users understand how rules impact fraud detection outcomes.

CLI (Command Line Interface): Enables quick, flexible management of LROL rules, making it easy to define, test, and deploy rule sets.

For hands-on resources, the LROL GitHub repository includes comprehensive examples, guides, and access to developer tools for configuring and optimizing LROL. You can explore these resources and get started at the LROL GitHub Repository.

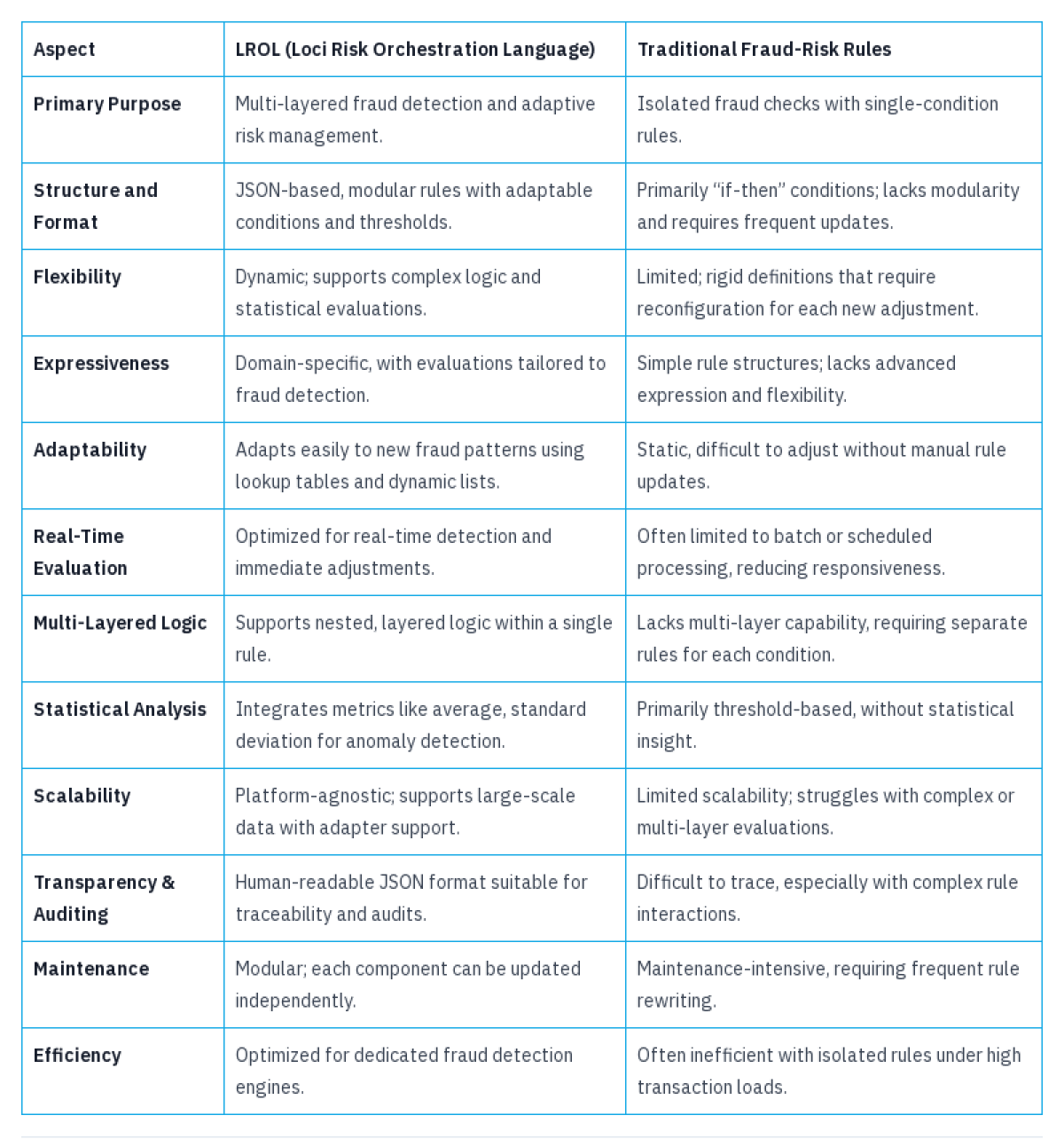

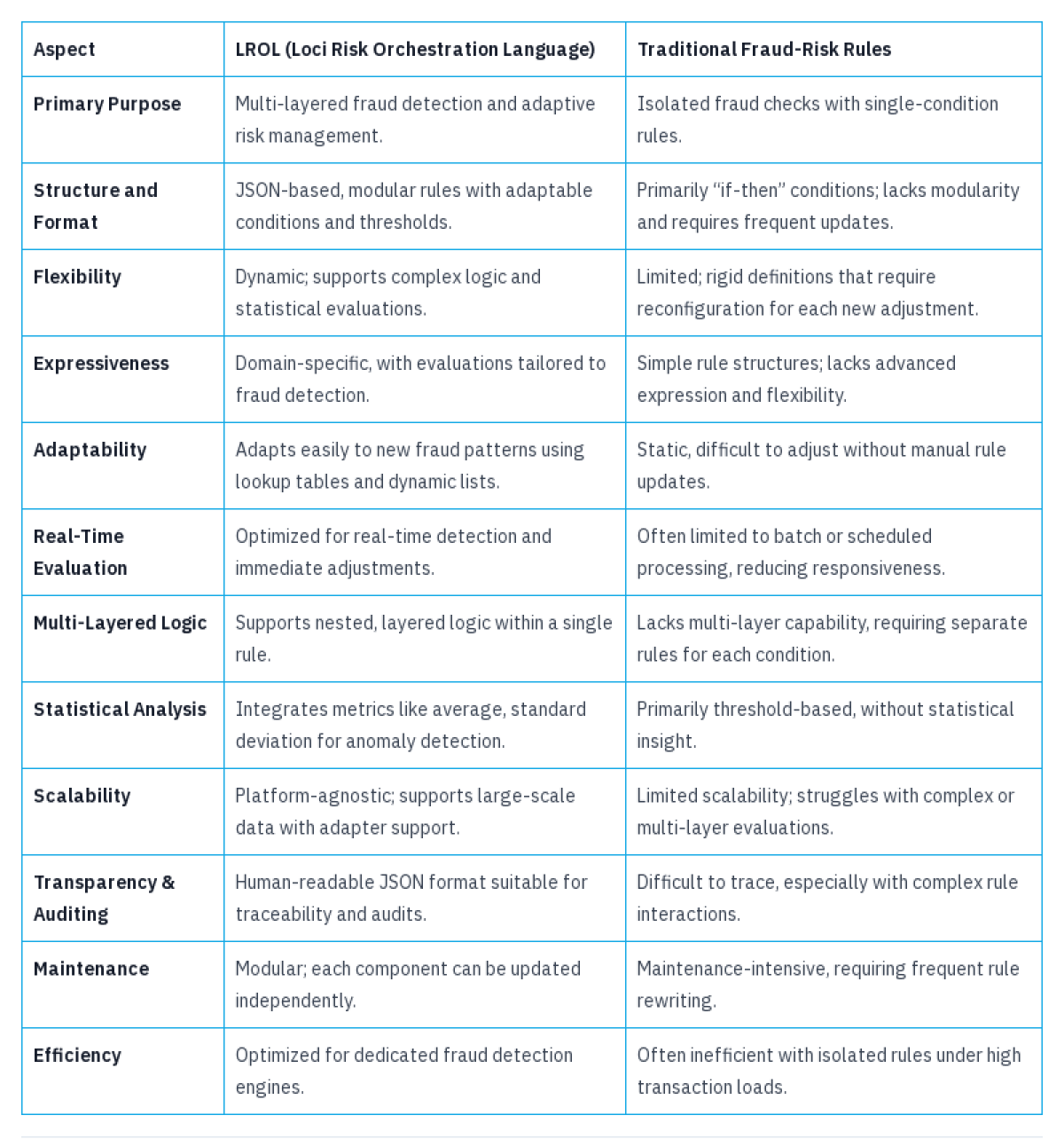

Comparison with Traditional Fraud-Risk Rules

To illustrate LROL’s advantages over traditional fraud detection systems, here’s a detailed comparison:

This highlights LROL’s flexible and modular DSL approach is better suited for dynamic fraud detection needs, providing adaptability and scalability not typically found in traditional rules.

Getting Started with LROL

Implementing LROL involves several straightforward steps, making it accessible to fraud analysts and developers alike:

Define Initial Rules: Start with simple rules in JSON format to become familiar with LROL’s structure.

Add Multi-Layered Logic: Expand rule definitions to include pattern recognition, anomaly detection, and statistical checks.

Enable Real-Time Evaluation: Configure LROL for real-time processing to facilitate immediate fraud detection.

Utilize Developer Tooling: Leverage the LROL parser, analyzer, and CLI available on GitHub for efficient rule management and analysis.

Following these steps will allow organizations to deploy a powerful, flexible fraud detection strategy, enhancing both response time and detection accuracy.

Conclusion

The Loci Risk Orchestration Language (LROL) sets a new standard for fraud detection and risk management through its modular, multi-layered approach. As a Domain-Specific Language, LROL provides the flexibility, transparency, and scalability that modern financial institutions require to stay ahead of evolving fraud threats. With features that facilitate real-time evaluation, statistical analysis, and adaptable rule definitions, LROL empowers compliance and fraud teams to build sophisticated fraud-risk strategies that respond to new challenges seamlessly.

By leveraging LROL, organizations can improve fraud detection accuracy, streamline rule maintenance, and align with regulatory standards, creating a robust and adaptive approach to fraud management. Access the LROL GitHub Repository for examples, developer tooling, and additional resources to get started.

Thanks to everyone who has contributed to reviewing this project, and sharing feedback and experiences to make ROL flexible.

References

—

https://engineering.grab.com/griffin

Domain-Specific Languages with Martin Fowler

Faces of Fraud https://www.sas.com/content/dam/SAS/documents/marketing-whitepapers-ebooks/ebooks/en/faces-of-fraud-113582.pdf

Mastermind: Using Uber Engineering to Combat Fraud in Real Time https://www.uber.com/en-NG/blog/mastermind/?uclick_id=5e1aaafd-6479-4dd9-808e-9a590a4dcbfb

Uber project RADAR https://www.uber.com/en-NG/blog/project-radar-intelligent-early-fraud-detection/

World Bank Group - “Fraud risk in fast payments” - https://fastpayments.worldbank.org/sites/default/files/2023-10/Fraud in Fast Payments_Final.pdf